Shaun and his wife are planning for their retirement, toying with the possibility of a 2nd investment house. They had bought their 5-room flat at about $280,000 in 2005. Fast-forward 10+ years later, they have fully paid up their flat which Shaun believed, is worth about $450,000 now.

Looks like after 10+years, they have a profit of $170,000. But there is still the accrued interest which is yet to account for( if they had not been using cash for housing payments). Shaun’s wife is relatively happy with the profits of over $100,000 and is thinking that having the flat is enough for their retirement.

Though I express some concern with the numbers; but retirement is quite a personal thing, the expected amount to retire differs from person to person. Over $100,000 may be more than enough for some of us to retire, while others might only feel secure if they have more. But before we jump into any conclusions, let me work through the numbers to see if this is enough for Shaun and his wife for retirement.

Assuming Shaun and his wife took 10 years to fully paid up the flat. For simplicity, the accrued interest be calculated based on after the house had been fully paid for.

Looking at the figures now, if Shaun and his wife decided to sell their flat in 2025 at $450,000, they be getting about $133,000 after less $280,000+est. interest of $36,747. It is still good amount for the couple to wait and see. And if they finally decide to sell in 2040, to breakeven they have to sell their flat at $280,000+est. $96,838 = $376,838.

By 2040, their house is at least about 35 years of age, will there still be demand for this house at more than $450,000? Things to ponder on will be: Is the house’s appreciation be good enough to still fetch over $100,000 profit in 20-25 years time? Is this The Location that will boost the value of the house further? Does the loan income eligibility/fund usage still support purchasers to pay for the price (that Shaun and his wife are looking for) for an older house?

So, let’s say Shaun and his wife are not sure if their flat can fetch the retirement sum that they want, they can still keep the flat, buy a 2nd unit together and rent out the flat right? That should cover some costs, isn’t it?

A 2nd unit together will mean an additional 7% ABSD ( assuming Shaun and his wife are both Singaporeans). 7%ABSD of $1million property is about $70,000.

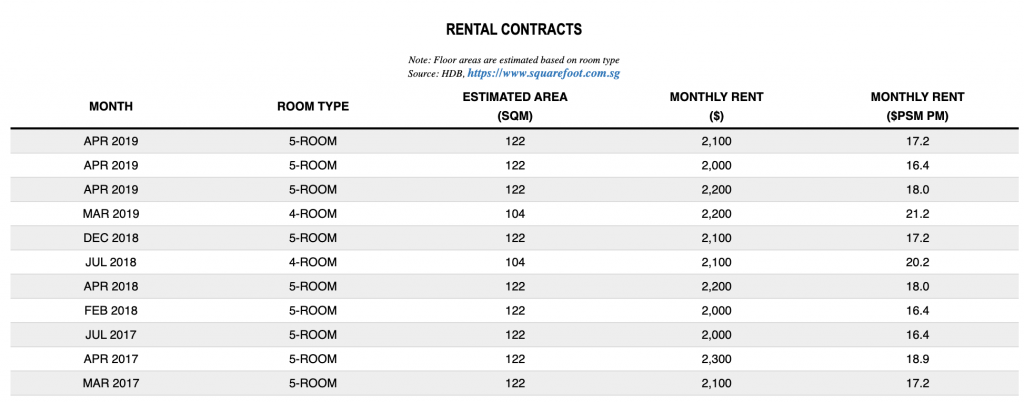

Renting out at about $2,300 per month, Shaun and his wife need to be renting for about 30.4 months before they can cover the ABSD. We have not yet taken into consideration of the accrued interest. If to include that in, Shaun and his wife need to rent above $2,300 every month.

Maybe Shaun’s wife and him decided that they do not want to ever sell their house and to keep it to collect rent for daily expenses in future. Similarly to selling, is the house sustainable for renting out at $2,300 for next 20-30years? Is Shaun and his wife able to take a rental cut if need be, as the house ages? And in the absence of alternative housing and that they have to rent out their rooms instead of the whole house, is about $2,300 a secure amount for Shaun and his wife? Is about $2,300 (or less) an amount for Shaun and his wife to retire ok without worries when it is time to retire?

While it is generally an Asian concept to think it is enough to have a house for retirement planning, but with evolving times, is it really enough? It is important in current days to know the value of your own house (be it a landed, private condo or HDB), the potential/risks and costs involved in holding the current house or even getting and upgrading.

There is no standard template in upgrading or retirement planning or getting that “2nd investment unit”. Do take time to find out in detail the important and yet easily missed factors while getting that upgrade/2nd unit/retirement house (eg. accrued interest rates, loan eligibility, holding costs, time factor). If you could start planning from the very 1st House, it might save you a lot of time and money in getting you to your retirement dream!