During the shop for a home, most owners do come across Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR). The loan eligibility of homeowners are based on their income which is capped at 60% for TDSR and 30% for MSR.

With loan eligibility assessment, most home-seekers be interested in the loan interest rate and loan tenure.

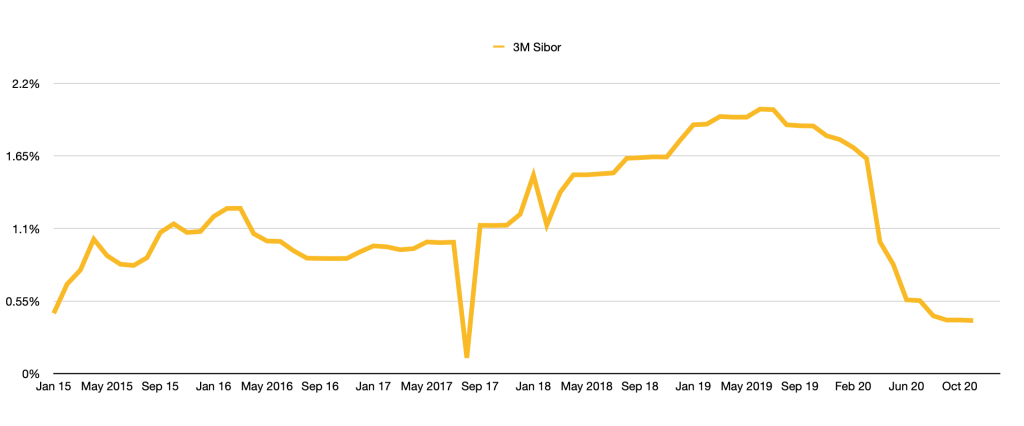

Sibor rates, which our mortgage packages are linked to, has been on the rise. Until recently due to the pandemic and the global economy slowdown. This leads to the concern – what happens if interest rates rise if you were to buy a house? And real estate veterans be asking what if you don’t and loan tenure drops ( which is definitely going to happen)?

Let’s see how does interest rates increment and loan tenure affects buyers.

Interest Rates

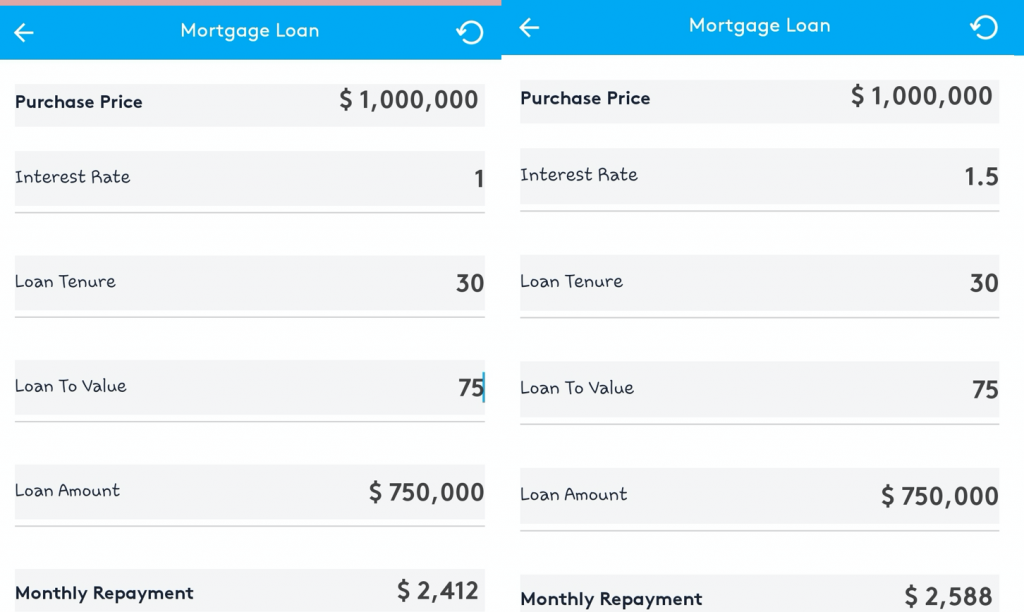

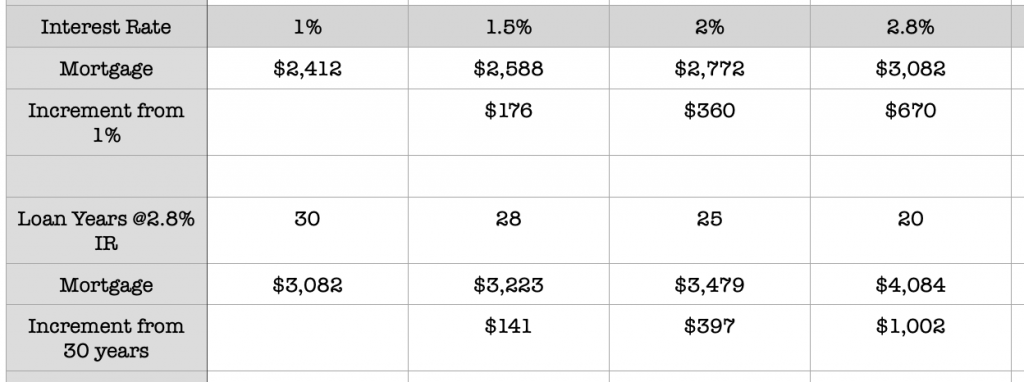

For a $1mil property at 30 year loan tenure, the increment of 0.5% interest rate resulted in $176 increase in mortgage.

A 2% interest rate resulted in additional $360per month.

And a 1.8% increment to 2.8% lead to $670 increment per month.

Interest rate increment 0.5%, 1%, 1.8% is scary but the mortgage increment is still within hundreds. Unlike the thousands of dollars that most expect.

Loan Tenure

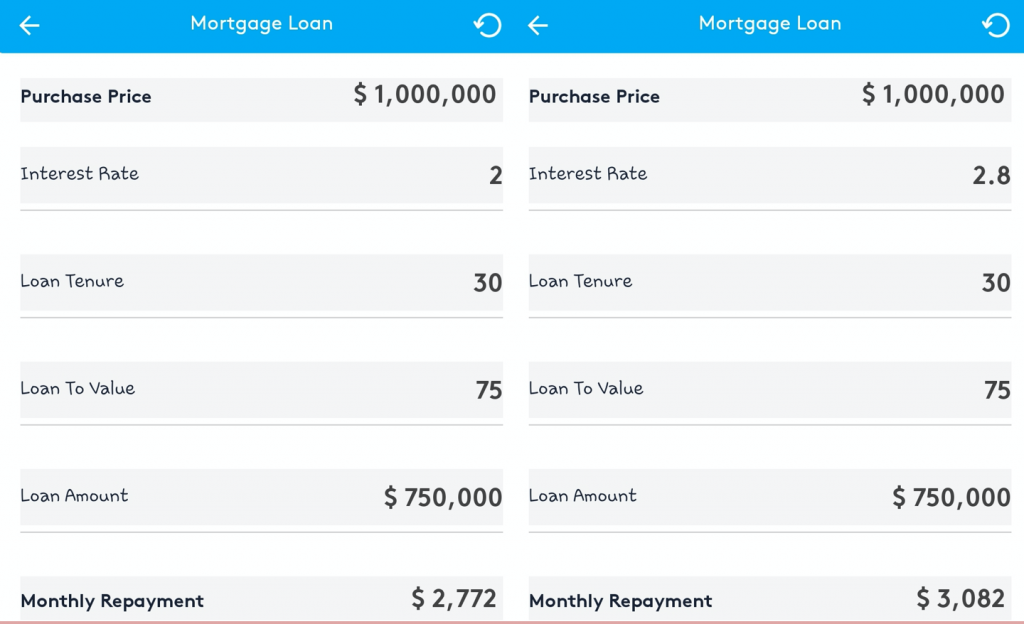

Next let’s check out how loan tenure period impact the mortgage. The maximal loan period for 75% loan to value ratio is 30 years.

Keeping interest rate same ( we know is impossible, but let’s just assume it is for simplicity), a drop in 2 years loan period resulted in $141 increment even if interest rate remains. A 5 year drop results in $397 increment and 10 year drop leads to over $1000 increase.

Summary

In summary, both interest rate hike or loan years drop results in mortgage increment. While both are a concern, interest rate hikes seem to have a lesser impact still within the hundreds range. But a lesser loan period can potentially cost more.

Although it is a valid concern to worry about the rise in interest rates, however this is still not within our control at our level. What some conservative home owners may do is to choose on a fixed rate mortgage package during the lower interest rate period. This may help them buffer against any potential huge hikes.

On the other hand, the drop in loan years is inevitable with age. That is not ambiguous. And there is significant difference in mortgage crossing the 25 year mark. And if the fear is on potential hikes, there is also no guarantee that interest rates will not grow with the less loan years.

Just imagine, lesser years, growing interest rates, how much more mortgage do you have to fork out each month?